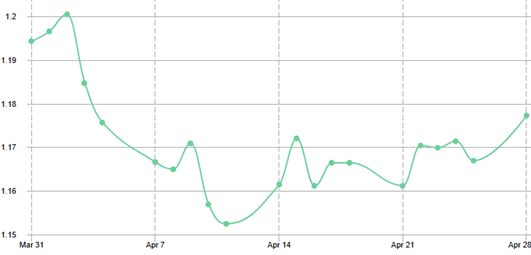

| Stock market stabilization sees a stronger Pound.. |

| If you have been following this report for a while, you will know that generally the Pound follows the performance of the S&P 500 index (and if you haven't you now know). The only difference (a pretty big one) in the current environment is that instead of it generally being Sterling (emerging) v Dollar (safe) that follows the trend, the USD has been replaced by the EUR. In a recent report I wrote about risk on and risk off investor sentiment. Well right now (and for the time being at least), the US government are all about good vibes, which is reflecting positively in financial markets. The S&P 500 has recovered 50% of the losses it incurred earlier this month when the index hit a 1-year low and it has been an almost identical recovery for GBP v EUR ..   A measure of 60 in market volatility was witnessed earlier this month, a seriously hyper-volatile score which is why we saw wild swings in all financial markets. This has now thankfully eased down to 23 (anything above 10 is deemed volatile). US Trade Secretary Scott Bessent said yesterday that many countries have offered "very good" tariff proposals (notably India & Japan) and that the US & China are in talks to de-escalate matters. In a calmer environment, investors are willing to take risks and this sees GBP strengthen as an emerging currency and the EUR & USD in particular weaken as safe-haven currencies. However, this can of course all collapse in a blink of an eye, especially as this all revolves around President Trump, so be careful in taking comfort that things look to be back on the way up. The Bank of England can too play a part in the recovery both positively and negatively next week. A 25bp interest rate cut is almost 100 certain, but its the further guidance that could help or hamper Sterling. |

Twitter

Twitter Facebook

Facebook linkedin

linkedin Google

Google