| UK consumer confidence rises to a 2-year high.. |

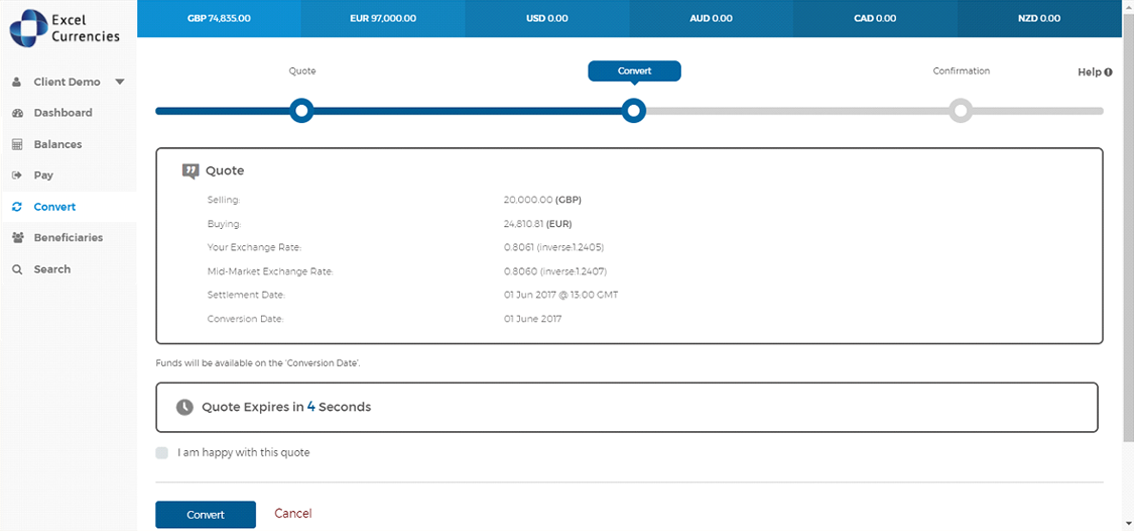

| The £-€ rate has gained 2% since the beginning of the year and is currently trading at one of the best times since mid 2022. The pair is up 3% compared to this time last year and so represents a fantastic opportunity to buy SPOT or forward. Yes, there is a good chance of more to come in the coming months, but that is no guarantee (especially in this market) and what goes up, must come down. The closer the mid-market rate gets to 1.20, the higher the chance of it eventually passing the psychological barrier. But, April 2022 was the last time 1.20 was hit and 1.21 (March 2022) is the highest the pair has been since 2016. In September 2022 the mid-market was 1.11 and in September 2020 the rate was in the 1.08's, to give you an idea of where the pair is currently trading in the cycle. The Euro has devalued across the board due to ECB President Lagarde's speech yesterday afternoon. She mentioned 'a summer rate cut was possible', whilst not ruling out an April interest rate cut, which money markets have priced in an 80% chance of happening. Elsewhere, the FTSE 100 has had its best week in 4-months and UK consumer confidence has strengthened for the first time in 24-months, amidst improved personal finances from falling inflation. |

Twitter

Twitter Facebook

Facebook linkedin

linkedin Google

Google