For decades, banks had the overseas payment space all to themselves. Thankfully times have now changed, with 7/10 customers choosing a specialist currency company rather than their bank to send money abroad.

Let’s take a look into why this has happened..

For best-in-class overseas payments, get in touch with us today. Our experienced traders are here to hold your hand through the world’s biggest market to ensure you don’t just survive, but you thrive in it.

Intro

Since 2004, we have been competing with banks on overseas currency payments and gradually over time, this battle has got easier and easier for us to win. At the beginning, banks were the only option available to customers unless they had a call from us/our competitors or were referred by someone that had used us.

Because we were not (and still aren’t really) a ‘household’ name with offices on every high-street and adverts on TV like most banks, there was naturally a trust issue when choosing either us or a bank to send money overseas.

However..

Since 2013 when the FSA renamed and rebranded to the FCA and completely changed how it will regulate companies in the UK, trust has become less and less of an issue because of the strict rules we must abide by to remain in business.

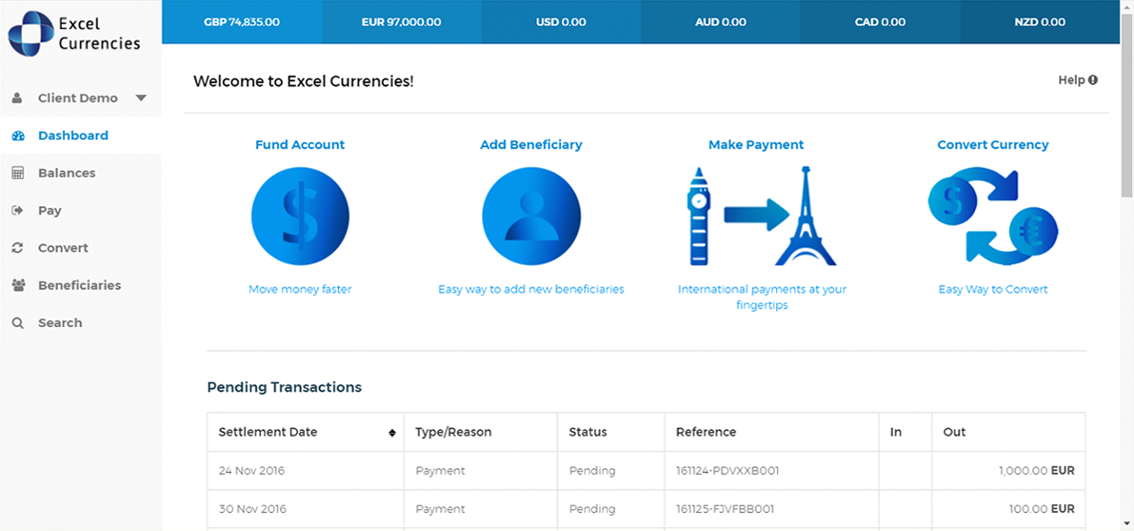

Another significant reason as to why customers started turning to us more rather than their bank was due to the fintech (financial technology) boom. Banks are huge and this makes them slow in changing processes and systems, not good when technology is moving so fast.

Now with marketing, a deep client-base and strategic partnerships for referrals, our hope is that no-one will choose their bank over a specialist currency company within the next 6-years.

And here’s why..

Cost

Cost was the original reason for customers choosing us over their own bank for overseas transfers, it was at the time the only way to win business against them. As a general rule of thumb, banks used to charge their customers 4%-5% on overseas currency payments via a poor exchange rate.

Because of multiple factors forced upon banks, this has now thankfully reduced to 2%-3% in recent times. Even with the banks charging a lot less by offering a better exchange rate to their customers, we are still 50% less expensive on average compared to them.

How does this work?

Us and the banks buy at the exact same wholesale rate (not available to consumers), we just offer a higher exchange rate than they do to customers. In other words, we profit less on exchanges compared to banks.

But how?

Just the same as other products that banks offer like mortgages, insurances, investments and loans, the banks won’t always be your best option. Plus, banks have set profit margins. They are in business to make money and their large overheads dictate they can’t give products and services away for free.

But more importantly, banks do not care about the overseas payment space because such a small pool of their customers have a need for this particular requirement. You would have seen adverts from your bank on pretty much all the products they offer, apart from currency exchange and this is because there is very little money in this product for them.

Transfers & fees

Banks were notorious when we first started in the industry for charging all kinds of fees to their customers. They were also painfully slow in transferring customers funds to another country.

Again, because of many factors forced upon banks, they have changed their ways here too. However, they still lag way behind us on these points..

Firstly..

Some banks will charge £10-£50 to transfer money abroad, depending on the amount being sent. Some banks will trick customers into thinking they are getting the best they can possibly achieve with slogans such as ‘No transfer fees’ or ‘Fee free transfers’.

This is because some customers do not understand how the FX market works and they believe they will receive the exchange rate that is on Google, Bloomberg etc which couldn’t be further from the truth. In essence when this happens, customers are saving a small fee but losing 2%-3% on the exchange rate.

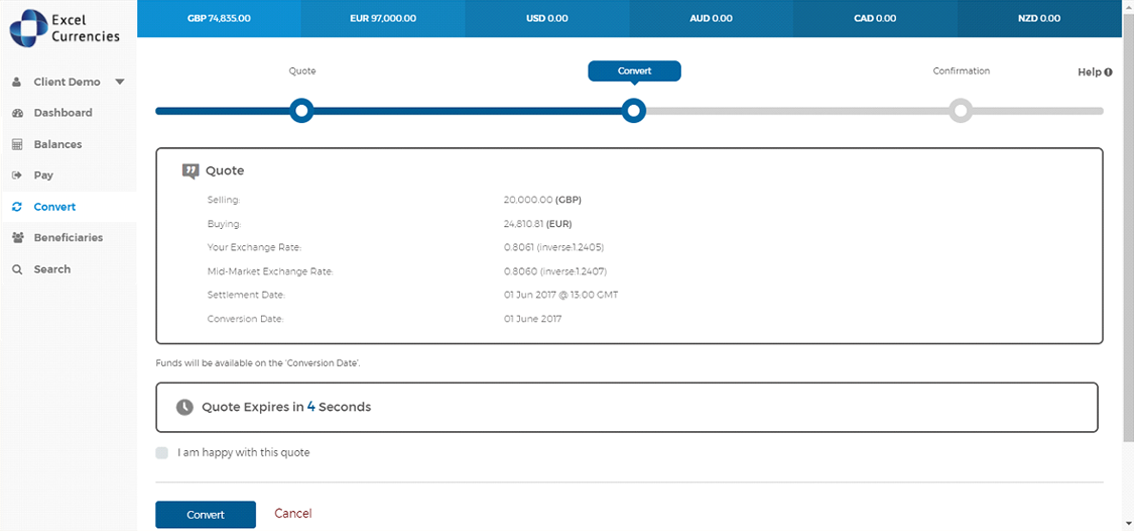

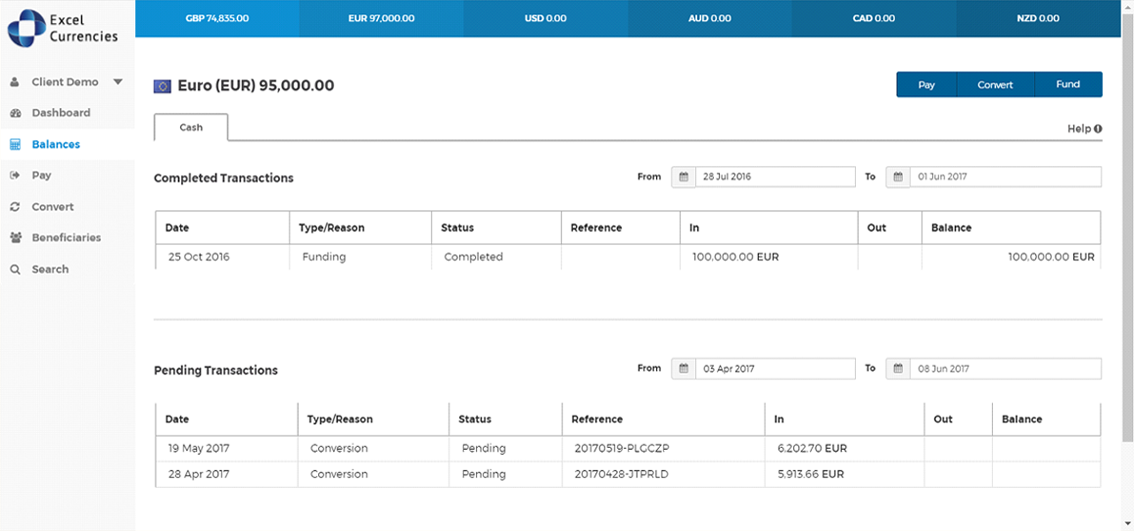

We charge no fees whatsoever and are transparent in the exchange rate we are offering when booking in a trade on your behalf. Unlike the banks who will either try and hide the real exchange rate via online banking or who will not tell you the real exchange rate when in branch unless you specifically ask for it.

Secondly..

Up until very recently, banks were taking a very slow 2-3 working days to credit funds in Europe for customers. This has now thankfully changed to 1-2 working days, but it still isn’t as fast as it should be. Our average credit time into Europe is 1-hour..

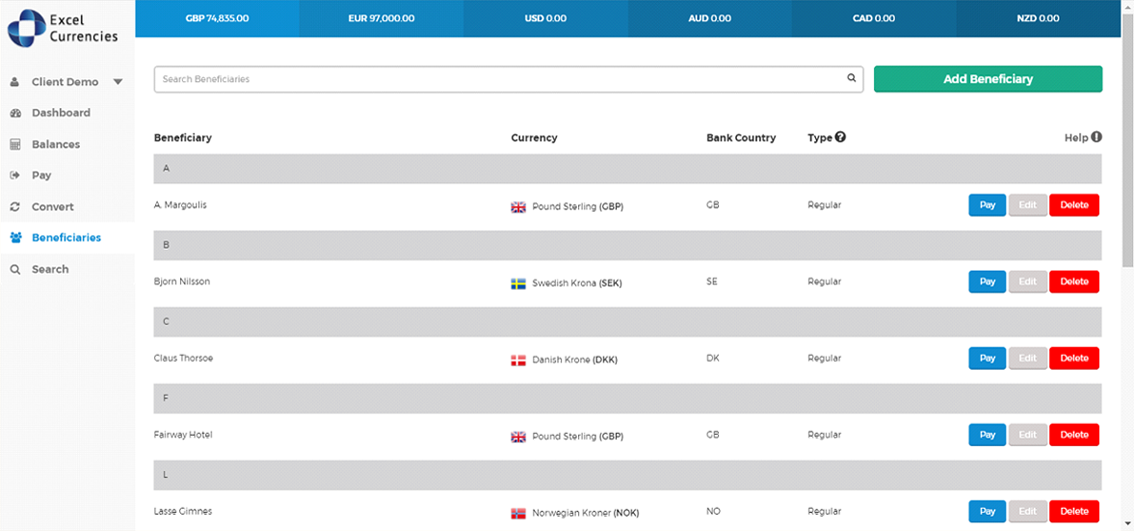

Depending on the amount and reason for transfer, it can be anything from 1-minute to 4-hours for your funds to credit overseas. We also make the payment overseas on your behalf, saving you the stress and hassle of doing it yourself online or at the bank.

Your bank cannot check account details of foreign accounts and so cannot help you against fraud here. We have certain protocols in place that means we will not send your money unless you have followed them, to protect you from potential fraud.

Understand and tackle your currency risk head on with the team at Excel Currencies.

Service

The FX market is not only the biggest market in the world, but it is one of the most volatile. £5trillion is traded daily, which swamps the £160billion in the biggest stock market the Nasdaq.

Exchange rates change every 2-seconds and move on average by 1% in a day. Having someone experienced in this market to guide you, is going to be worth its weight in gold. Your bank will not offer an experienced, personal currency exchange service to you, you will be on your own.

Here at Excel Currencies, you will have a dedicated account manager who will have over 10-years’ experience in the FX industry. They will effectively hold your hand throughout the process, they will have your best interests at heart and you will not be treated like just another number.

They will be available on the phone, email, facetime and WhatsApp and they will save you an enormous amount of money, time and stress by taking care of things you know nothing about in comparison.

Specialist currency tools

Banks move money from account A to account B for you safely. Excel Currencies moves money from account A to account B for you safely, cost-effectively, quickly and by guiding you.

Because of the banks’ lack of interest in overseas payments, they are

failing their customers when it comes to risk management on large exchanges

like overseas property transactions. Risk management comes in the form of

specialised currency tools which are offered by FX market experts such as Excel

Currencies.

These products greatly reduce risk on a volatile market, save

you time and potentially earn you more money, making them absolutely crucial to

overseas property buyers.

Security

Under the Financial Services Compensation Scheme (FSCS), all

banks protect up to £85,000 of customer money. In the unlikely event that

a bank fails, the FSCS will step in and compensate victims up to the value of

£85,000.

Specialist currency companies do not offer the same protection

as a bank. Instead, the Financial Conduct Authority (FCA) insist that we ‘safeguard’

customer funds. Safeguarding is a set of laws that are designed to ensure that in

the unlikely event of a specialist currency company failing, customer money is returned

in full.

To explain a little further; once customer funds arrive with a

specialist currency company like ourselves, we must place these funds into a separate

safeguarding account (away from our profit accounts) with a Tier 1 bank such as

Barclays bank. These funds will remain untouched until a trade has been exchanged

and an onward payment has been made.

Effectively, because of the difference in regulations, both Electronic Money Institutions (EMI) and Authorised Payment Institutions (API and which is us) offer better protection of customer money than banks (£85,000 versus 100%).

Excel Currencies has been in business since 2004 and are fully authorised and regulated by the FCA. Customer funds are held in safeguarding accounts with tier 1 banks only. Excel Currencies use sophisticated anti-fraud measures to keep your money safe.

Find out how we can help you by calling us on 01322 221 121 or email us at info@excelcurrencies.com.

Twitter

Twitter Facebook

Facebook linkedin

linkedin Google

Google