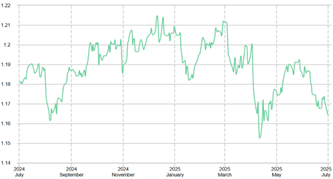

GBP v EUR downward trend continues..

|

| Well this doesn't look very good..

As you can see, the £-€ recovery in May didn't reach the heights of the consistent Q4 last year or February spike, where mid-market was in and around 1.20.

This is what many expected to see happen after the Trump tariffs and Labour debt drama faded towards the end of April.

You can also see the downward trend in June and that we are quickly approaching the second worst time to be buying Euros in 12-months.

We don't currently foresee the lows of 1.15 mid-market near-term, but trends can often be strong enough to break consensus. With nothing of significance happening in the market this week GBP v EUR has lost 0.5% and GBP v USD hsa gained 0.5% because of trends.

Another concern is Goldman Sachs latest guidance on £-€.

The investment bank has been bullish in recent times, expecting 1.22 by year-end. But with BoE interest rate concerns (due to UK growth) combined with a suggested continued € out-performance this year, the bank now sees nowhere near that rate.

There is no doubt things look a bit bleak here at the moment and it may make some feel a little uneasy, but no need for panic stations (yet).

With a large exchange in the pipeline, this is where hedging excels. Reduce your risk by converting some of what you need, whilst staying in the game for the rest. |

|